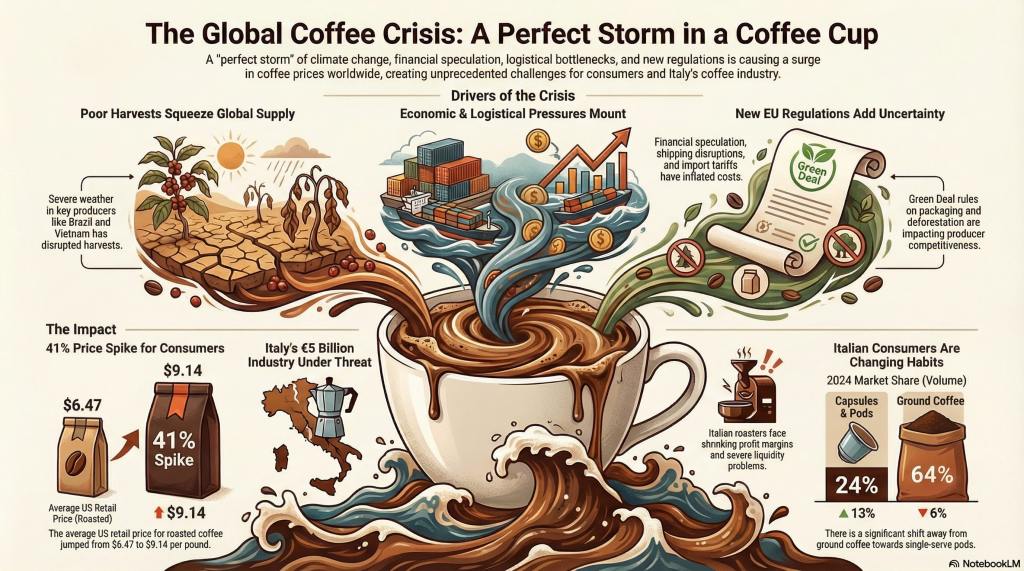

𝐂𝐨𝐟𝐟𝐞𝐞 𝐩𝐫𝐢𝐜𝐞𝐬 are in a perfect storm, for a while now. But the spike trend (300% over slightly more than 2 years) is not likely to stop in the next few months.

Let’s see why:

🌳𝐂𝐥𝐢𝐦𝐚𝐭𝐞 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬: drought and heavy rains in 2024 caused poor harvests in key producing countries like Brazil and Vietnam.

🫰 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐬𝐩𝐞𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧 and 𝐬𝐭𝐨𝐜𝐤𝐩𝐢𝐥𝐢𝐧𝐠 are reducing available supplies; coffee is traded on markets, and futures are not only helping to sustain the speculative bubbles, but at the moment do not point to lower prices soon.

⚓️ 𝐓𝐫𝐚𝐝𝐞 𝐛𝐥𝐨𝐜𝐤𝐚𝐝𝐞𝐬 and issues in the Suez Canal are contributing to increasing costs and making shipments less efficient.

💵 𝐔𝐒 𝐭𝐚𝐫𝐢𝐟𝐟𝐬, even if rolled back now, did not help. The Trump administration just rolled back the tariffs on Brazil, after removing the ones from all other countries, realizing that the USA cannot sustain internal demand for coffee with highly taxed imports. Coffee cannot physically grow at certain latitudes, and this shows once again how often tariffs are self-inflicted wounds for the economic system, in particular when imposed on goods of which you are not a net exporter.

The prices will react slowly to tariff removal, if ever, and therefore consumers won’t notice this in the immediate aftermath.

📜 𝐄𝐔 𝐥𝐞𝐠𝐢𝐬𝐥𝐚𝐭𝐢𝐨𝐧 like the Packaging Waste Regulation (PPWR) and the EU Deforestation Regulation (EUDR) — even if, in part, most likely delayed — are threatening to increase costs and red tape; in turn are also fostering stockpiling by the biggest global traders, which are at a natural advantage to comply vs. SMEs.

🏮𝐂𝐡𝐢𝐧𝐚 is discovering an appetite for coffee, buying huge quantities especially from Vietnam, which is now a primary sourcing market for key players in Italy and the EU.

Companies slightly increased prices in recent years (an espresso in Italy went from 1€ to 1.2€ on average), but not even close to covering such a spike in the raw material pricing.

Major Italian players are trying to find a way out, since they are starting to suffer 𝐦𝐚𝐫𝐠𝐢𝐧 𝐞𝐫𝐨𝐬𝐢𝐨𝐧 and 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐜𝐫𝐢𝐬𝐞𝐬, but the most likely outcome would be a further increase in the average cup, which I see at least going to 1.4/1.5 € in the short/medium term.

Discover more from FOOD LAW LATEST

Subscribe to get the latest posts sent to your email.